Fixed internet traffic reaches 50 GB/month/inhabitant

10.12.2021

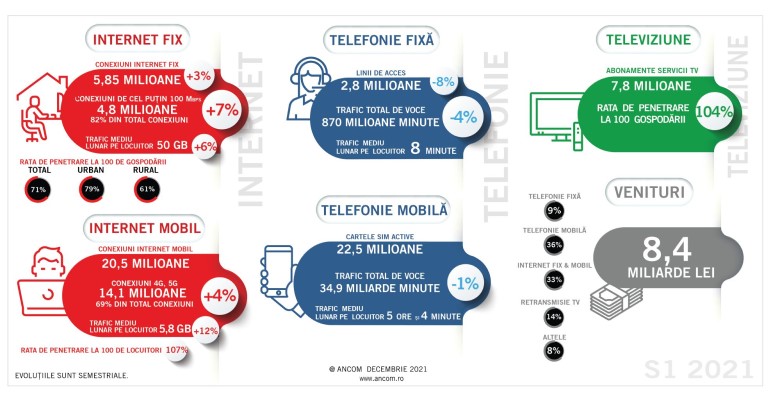

”In the first half of 2021, the Internet resumed the steady growing trend it witnessed before the pandemic: the number of connections increased by 3%, while fixed internet traffic increased by 6%. H1 2021 also saw fibre-to-the-home connections (enabling ultra-high speeds) rising above the milestone of 3 million homes. Concerning mobile internet, 4G and 5G connections amounted to approx. 70% of the total, up 4% compared to the previous semester, therefore the average monthly traffic per inhabitant reached almost 6 GB." declared ANCOM Vicepresident Eduard LOVIN, on the occasion of the 18th edition of the Mobile Communications Gala. Infographic available here.

ANCOM’s Report on the telecom market in H1 2021 is available, in Romanian, here. The main highlights are presented below.

Fixed internet

- Â With +166 thousand new connections in the first 6 months, the total number reached 5.85 million (+ 3%), of which 82% enabling speeds higher than 100Mbps;

- The average monthly traffic reached 50 GB per inhabitant (almost 1.7 GB/day);

- At national level, 7 out of 10 households have fixed internet connections, i.e. 8 out of 10 in urban areas and 6 out of 10 in rural areas, a clearly higher growth in rural areas (+ 6%) than in urban areas (+ 1%);

- Â By number of connections, the top 3 providers were: RCS&RDS (61%), Telekom Group (17%) and Vodafone (12%).

Mobile internet

- Â The total number of active connections (20.5 million) remained relatively unchanged, and 69% of them allow 4G and 5G;

- 18.8 million (+ 1%) connections are related to mobile telephony, on mobile phones, while 1.7 million are dedicated to mobile internet, via modem/card/USB (-6%);

- Â The average monthly traffic was 5.8 GB per inhabitant, i.e. almost 200 MB/day;

- By number of active connections, the top 3 providers were: Orange (39%), Vodafone (25%) and RCS&RDS (20%).

Mobile telephony

- The number of active SIM cards stays relatively the same, the growth by 300 thousand of the number of subscription-based SIM cards being cancelled by the decrease in the number of prepaid SIM cards, by 400 thousand;

- Â Voice traffic stays at about 35 billion minutes (-1%), i.e. a monthly average of 5 hours and 4 minutes per inhabitant, while SMS traffic has halved in the last two years, reaching a monthly average of 24 SMS/inhabitant.

- By number of active SIM cards, the top 3 providers were: Orange (38%), Vodafone (29%) and RCS&RDS (17%).Â

Fixed telephony

- Â The decrease in the number of subscribers and lines continued (-8%), but the total voice traffic dropped by only 4%;

- Â By number of subscribers, the top 3 providers were: RCS&RDS (40%), Telekom Group (37%) and Vodafone (21%).

Television

- Â 7.8 million TV subscribers (-0.1%), of which 6.0 million received TV services by cable (77%, + 3% compared to the previous semester), 1.6 million by satellite-DTH (-9 %) and 0.1 million (-3%) by means of IPTV;

- By number of subscribers, the top 3 providers were: RCS&RDS (63%), Telekom Group (14%) and Vodafone (11%).

Telecom revenue

- Revenues from the telecom sector saw a slight decrease (-1%) in H1 2021, totalling RON 8.4 billion (EUR 1.7 billion);

- Mobile telephony generated 36% of total revenues, fixed and mobile internet 33%, TV retransmission 14%, fixed telephony 9%, and other types of networks/services 8%;

- By the revenues obtained from electronic communications, the top 3 providers were: Orange (25%), Vodafone (24%) and the Telekom group (24%).

Statistical data report

ANCOM prepared the statistical data report on the Romanian electronic communications market for H1 2021 based on statistical data reported half-yearly by the providers under the obligation to send indicator values by service categories, according to Decision no. 333/2013, and published it – in Romanian – here.

Â

top

top