17.05.2023

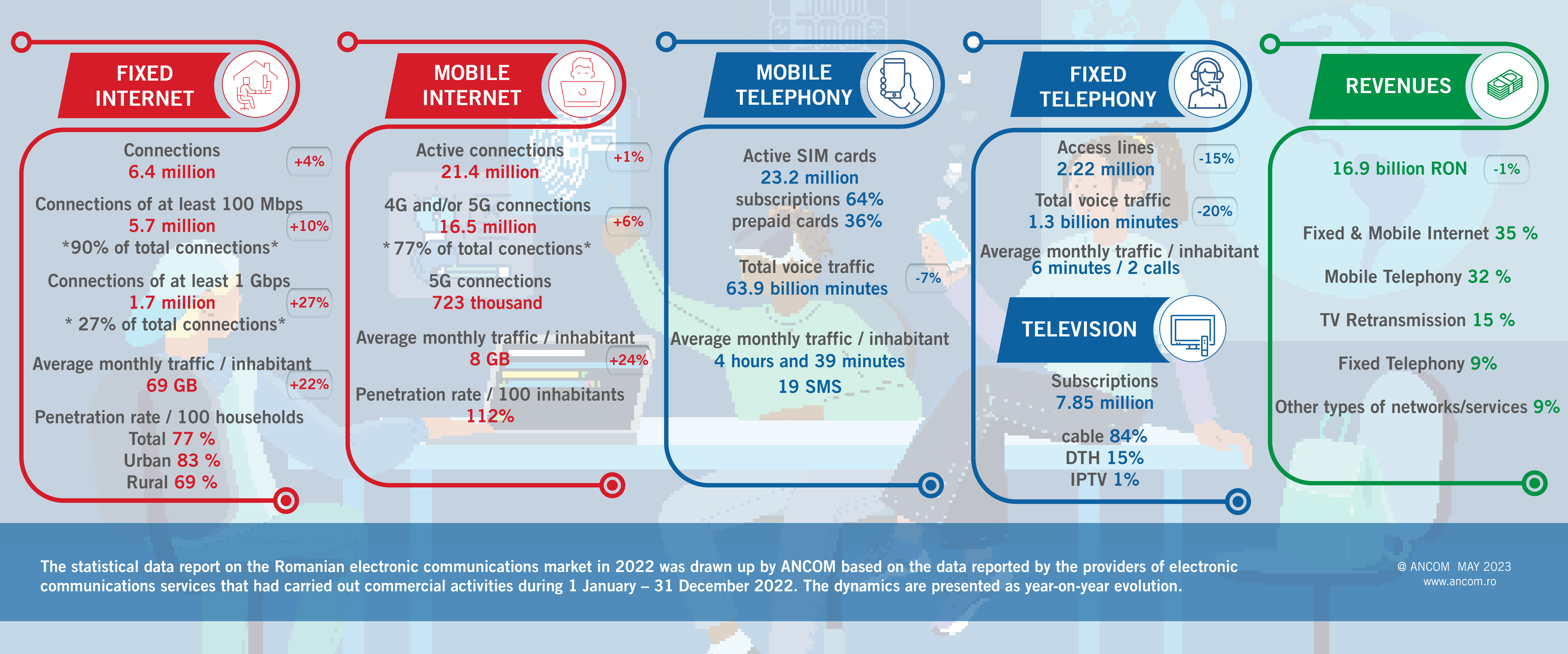

In 2022, the urban-rural gap in the fixed Internet segment decreased by 3 percentage points, reaching 14%, due to new connections installed in rural areas. Thus, the penetration rate per 100 households reached 77% at national level, respectively 69% in rural areas and 83% in urban areas. Infographic here.

ANCOM's report on the telecom market at end-2022 is available here, with the following highlights:

Fixed Internet

- This segment saw 4% growth; there were 6.4 million connections in 2022, 90% of which allow an internet speed of more than 100 Mbps.

- 27% of connections (1.7 million connections, up by +27%) allow speeds of at least 1 Gbps.

- The number of connections in rural areas witnessed a higher growth (+7%) compared to that in urban areas (+3%).

- The average monthly traffic reached 69 GB per inhabitant (+22%), i.e. 2.4 GB/day.

- At national level, the penetration rate per 100 households reached 77% (83% in urban areas and 69% in rural areas).

- By number of connections, the top 3 providers are: RCS&RDS (67%), Orange Group (20%) and Vodafone (12%).

Mobile Internet

- The total number of active connections increased slightly, reaching 21.4 million, 77% of which allowed 4G and/or 5G (16.5 million).

- The number of 5G connections increased 3 times YoY, reaching a total of 723,000 connections at the end of 2022.

- 19.85 million connections are used for both mobile telephony and mobile internet, and 1.52 million are used only for mobile internet access (data only).

- The average monthly traffic was 8 GB per inhabitant (+24%), i.e. almost 270 MB/day.

- By number of active connections, the top 3 providers are: Orange Group (40%), Vodafone (24%) and RCS&RDS (24%).

Mobile Telephony

- There were 23.2 million active mobile SIM cards at the end of 2022, of which 64% are subscription-based and 36% are prepaid cards.

- The number of subscription-based SIM cards increased by 6%, while the number of "active" prepaid SIM cards decreased by 6%.

- Total voice traffic saw a 7% decrease, to 64 billion  minutes, while the average mobile traffic per inhabitant was 4 hours and 39 minutes/month, respectively, 19 SMS/month.

- By number of active SIM cards, at end-2022 Orange group held a market share of 37%, Vodafone 30%, and RCS&RDS 21%.

Television

- The number of subscribers to TV services stayed at 7.85 million.

- The users keep preferring migration to cable retransmission services (+6%, up to 6.6 million subscribers) over satellite/DTH services (-21%, up to a total of 1.2 million).

- According to the total  number of subscribers at the end of 2022, RCS&RDS had a market share of 69%, Orange Group 16%, and Vodafone 11%.

Revenues from the telecom sector

- Revenues from the telecom sector recorded a slight decrease in 2022 (-1%), totaling 16.9 billion lei.

- Fixed and mobile Internet generated 35% of the total revenues, mobile technology 32%, retransmission of TV programs 15%, fixed telephony 9%, and other types of networks/services 9%.

- Based on the revenues obtained from the provision of electronic communications networks and services, the top 3 providers were: Orange Group  (40%), Vodafone (24%) and RCS&RDS (24%).

Statistical data report

The statistical data report on the electronic communications market in Romania for the H1 2022 is carried out by ANCOM based on the statistical data reported by the providers who have the obligation to transmit to ANCOM the values of the indicators corresponding to all the categories of services according to Decision no. 333/2013, and is available here. This press release presents YoY developments in the Romanian market.

Â

top

top